Why use a PEO for your companies Workers Compensation?

Professional Employer Organization (PEO) is the most cost effective approach for the majority of small and medium size businesses to obtain workers’ compensation insurance.

- PEOs use Economies of Scale to Obtain Workers Compensation at a rate an employer could never receive on their own.

- PEOs improve the employer’s cash flow by eliminating the large down payments associated with the purchase of workers’ compensation insurance.

- PEOs eliminate the time consuming and costly audit process that employers have to go through. With a PEO there are none.

- PEOs normally mandate that each client employer has a return to work program that puts employees back to work on modified duty as soon as the medical provider allows light duty work. In the long run this saves money for the employer.

- Employers with a high experience modification factor, E-mod, (also referred to as an X-mod in some states), frequently join a PEO as the employer takes on the E-mod of the PEO. Usually the E-mod of the PEO is about 1.0 or lower. This can lead to tremendous savings for the employer.

- PEOs also provide safety programs to the employer at no additional cost.

Howard Leasing Works With Leading Providers

Howard Leasing maintains fully insured programs with SUNZ Insurance Company, headquartered minutes from our corporate offices in Bradenton, FL. SUNZ Insurance Company was founded specifically for Professional Employer Organizations (PEOs), Staffing Agencies and Large Companies.

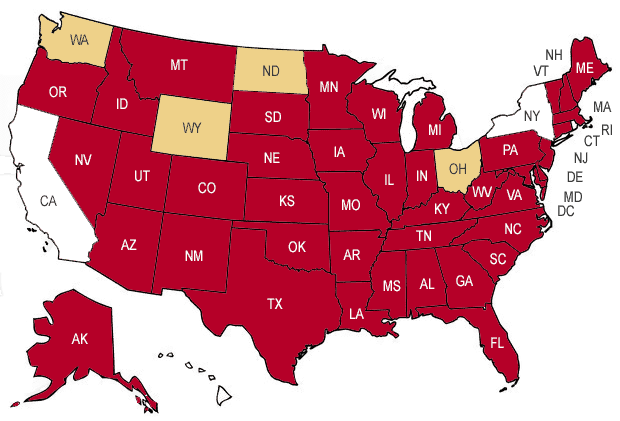

Legend

Red = Howard Leasing Covered States

Gold = Monopolistic States

White = Non-Covered States

Howard Leasing, maintains AM Best "A" through Sunz Insurance and United Wisconsin Insurance Company with coverage in 49 States.

Information Request