In our previous post, we outlined the importance of reporting accurate, transparent employee class codes to your insurance provider or PEO for the calculation of your company’s workers’ compensation policy. Here, we’re taking a step back to explore your options regarding how and when these details are reported, which in turn affects how and when your policy is calculated, and how and when your company is billed for your plan.

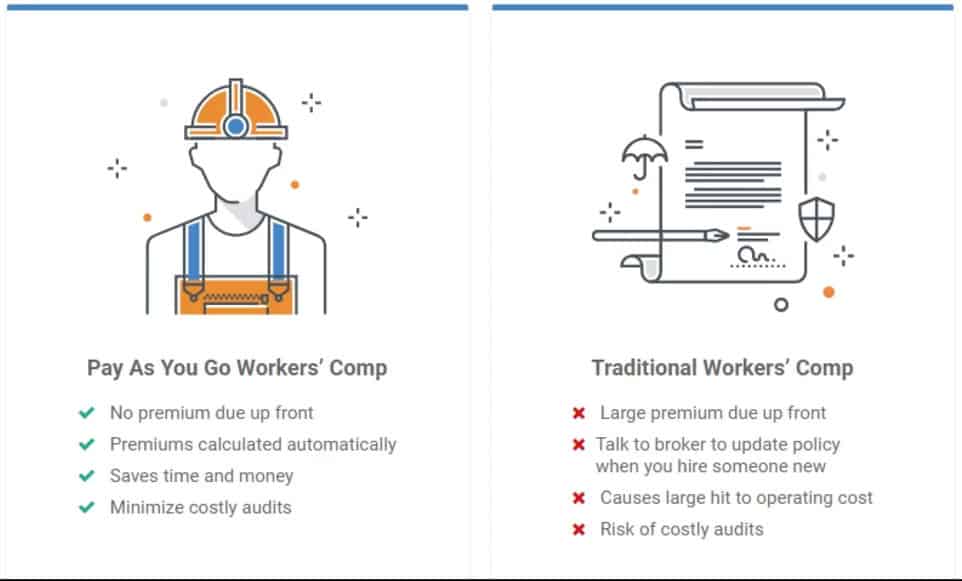

In a traditional workers’ comp plan, your policy is determined at the beginning of the year based on your estimation of your company’s gross annual wages. You make an upfront deposit and then your insurer bills you quarterly, all based on that initial estimate. At the end of the year, the insurer audits your company and uses that audit to calculate the real cost of your policy, as compared to the payments you’ve made based on the initial estimation. If you’ve paid too much, congratulations, you’ll receive a refund or your overpayment may be rolled over into the coming year’s policy expenses. If you’ve paid to little, you’ll be billed for the difference.

The advantage of a traditional workers’ comp plan is a relatively stable process throughout the year; if you’re handling your workers’ comp plan in-house, then there’s less administrative burden once the initial plan is in place.

The disadvantages of a traditional workers’ comp plan are the obvious potential discrepancies in payments, as well as the up-front deposit. You’re either paying too much throughout the year, or you’re hit with a big bill at the end. If your company downsizes during the year, your policy would be accounting for employees who were no longer there. Likewise, any growth your business experienced during the year would not have been accounted in the policy, leading to additional year-end expenses to make up for it.

And any changes during the year in the work being performed necessitates changes in your class codes, which again would change the cost of premium from the original calculation.

With PayGo, or pay-as-you go, your workers’ comp premium amount is calculated each and every payroll, so that each payroll you’re only paying the exact amount for your current employees and their current class codes. You reduce the initial up-front deposit, and you eliminate the need for a year-end audit. Your company isn’t spending unnecessary money throughout the year, nor is it hit with a big bill at the end of the year.

Of course, if you’re handling your payroll in-house, pay-as-you-go represents an additional burden on your administrative staff, who have to help the insurer recalculate premiums on a regular basis. That’s where PEOs come in.

PEOs were among the initial developers of the pay-as-you-go workers’ comp solution. With a PEO that’s already handling your payroll—and therefore constantly organizing firsthand knowledge of how many employees you have and what they’re doing—it only makes sense to adopt a pay-as-you-go workers’ comp plan that can be automatically and accurately folded into your payroll services. Your company receives all of the advantages of the pay-as-you-go plan with none of the additional administrative load. Win-win.